Privatisation, if done right, is an important driving force for growth. Given the pessimistic economic outlook for Europe, privatisation should be put high on the political agenda. Yet doubts remain whether all sectors are suitable for private ownership. A European privatisation monitor, a best practices handbook – such elements should be part of an all-important European strategy for growth to be put forward by the new EU Commission.

These are the conclusions of a debate on privatisation that United Europe and the Bertelsmann Stiftung held on October 13, 2014, in Brussels. With both institutions cooperating closely on the programme and the invited panellists, there were about 150 guests attending.

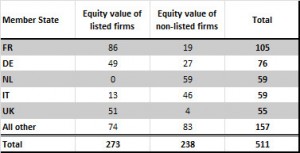

Privatisation also has a revenue aspect, as Christian Helmenstein, co-author of the study “Privatisation Potential in the European Union” explained. The detailed analysis which he presented in Brussels covers 14 EU countries (the ten biggest Eurozone countries by GDP as well as Britain, Poland, Romania and the Czech Republic). It shows that revenue from the privatisation of publicly held company stakes could amount to EUR 511 billion.

The Economica Study

Economica, the Vienna based institute that conducted the study for United Europe, identified a total of 263 companies with a turnover of more than EUR 100 million that could be privatised. Sovereign mandates, the health and education sector as well as real estate directly held by public authorities were excluded. “We underestimated the privatisation potential rather than overestimated it,” Helmenstein said in the main lecture hall of the representation of the state of North Rhine-Westphalia to the EU where the event took place (and many thanks for its generous hospitality!).

EUR 511 billion may seem like a huge figure – but in comparison to the enormous towering public debt, it’s fairly small fry. According to Economica’s study, the grand total that could be achieved by privatisation would only amount to 4.4 percent of the total debt of EU member states. “This underlines how enormously large public debt levels are these days,” Helmenstein explained in his presentation. Debt reduction has to be done by restructuring methods rather than privatisation.”

The first conclusion from Economica’s analysis is that governments should not use any of the money raised through privatisation for consumptive purposes. “It is absolutely imperative that we use these funds wisely,” Helmenstein said, suggesting that one area of investment that would yield high returns in term of growth was the expansion of the broadband infrastructure.

The second conclusion is even more far-reaching: the most important benefit of privatisation is neither the amount of money that can be raised nor the purposes that such money can be spent on. It is the fact that privatisation makes companies more productive which in turn improves competitiveness and creates growth.

Lagging behind most of the world

Of course, this will only happen if privatisations are transparent and if the state imposes the necessary regulation. “We need a handbook of best practices. We need a professionalization of privatisation,” Helmenstein said. “If we want to reap the benefits of privatisation, we need a strong state and effective regulation. “

“It’s a good time to be reflecting on privatisation,” said Wolfgang Schüssel, President of United Europe and former chancellor of Austria, who was moderating the debate. ”Today, we need a growth agenda.” Schüssel pointed out that over the past decade, South Korea’s labour productivity had increased by 58 percent. The United States had a 25 percent increase and Japan 17 percent, while Europe’s productiviy only grew by 11 percent.

Based on its calculations, Economica Institute gave an estimate of the growth effect to be expected through the sale of state assets. Even a partial privatisation could add 0.2 percent to EU growth, translating into a yearly GDP gain of EUR 24 billion, Helmenstein said. The reason for the productivity gains was that private owner operated according to different incentives and information than public owners.

A highly sceptic public

Still, in crisis-ridden Europe, privatisation policies tend to evoke both fears and dislikes. Sylvie Goulard, a French Member of the European Parliament, who took part in the panel on privatisation, reminded the audience of the current controversy over France’s highways. When they were privatised nineyears ago, the conservative government of the time considered the sale to be a success. Today, however, the French public was wondering whether it would not have been more useful to keep them in state ownership so as to benefit from the profits generated.

“Privatisation may reduce losses, but also income,” Goulard, who is also a member of the board of United Europe, said. “People are happy with the money at the time of privatisation, but some years later they cry that they don’t have the income anymore.”

Fabrizio Saccomanni, former Minister of Economy and Finances in Italy and Director General Emeritus of the Bank of Italy, was also somewhat ambiguous about privatisation policies, placing far more importance on a European investment strategy to create growth. “I don’t think that there is a positive climate for going forward with a new wave of privatisation,” Saccomanni said during the panel debate. Because of the financial crisis, there was a general impression that liberal economic policies had led to a situation where profits were being privatised and losses socialised.

“We take our wealth for granted”

Also, if state holdings in key companies dropped below a certain threshold – 30 percent in Italy – the state would no longer be able to appoint the top management, Saccomanni added. A large part of the Italian public was critical of such a loss of control. Yet overall, Italy’s experiences with privatisation had been mostly positive. In the 1990s, Italy had sold off a lot of publicly controlled entities in order to meet the Maastricht criteria. The entire banking system was privatised to good effect. “In the financial crisis, no bank in Italy had to be bailed out,” Saccomanni recalled.

Under the governments of Mario Monti and Enrico Letta, privatisation was put back on the agenda. “We had to show that we were doing everything possible to reduce the public debt,” Saccomanni, who served in government under Letta from April 2013 to February 2014, said. Italy was expecting to raise about 40 billion Euro revenue from privatisation over the next four years. “This will not have an immediate impact on the public debt, but it was important internationally: Italy signalled that it was willing to attract foreign investors.”

Leonhard Birnbaum, member of the executive board of the privately owned German energy company E.ON , picked up on this last point. He warned of a bleak future if Europe did not manage to return to growth and attract investment. “We take our wealth too much for granted, we are too complacent,” Birnbaum said in reaction to a question from the audience. “We will not get investors if we are perceived to be a low-growth area. Maybe the biggest advantage of privatisation would be that it makes us more dynamic.”

Better record on safety issues

Birnbaum gave several examples to show how widely sensitivities about privatisation differ in Europe. In France, for instance, people saw no problem with the waterworks being privately owned. In Italy, the privatisation of the savings banks was a good experience. In Germany, in contrast, private ownership of water companies was highly unpopular and selling the public savings institutions would be unthinkable. Yet here, the public did not in any way object to private companies running nuclear power stations. “We need to combine the right ownership with the right regulation,” Birnbaum concluded.

Some other perceptions of privatisation were erroneous as well, Birnbaum said. For instance, privately owned German utilities like E.ON were under such enormous financial pressure that you could actually say that the profits were being socialised and the losses privatised. Nor did private ownership lead to rising prices. E.ON had managed to keep costs stable in nominal terms over the last 15 years. The fact that electricity prices had risen sharply was exclusively due to taxes and levies.

“There is an advantage of private ownership for instance in the area of safety, health and environment,” Birnbaum continued. “Private companies can introduce a focus that makes a difference. We can’t afford not to do that – we would come under terrific pressure from the capital markets.”

The new Commission’s agenda

Yet the key issue for companies was not the ownership structure, but the exposure to market forces which forces them to become more competitive, the E.ON board member said. “The issue is that we need more efficiency and more competitiveness. We can have state companies if they are exposed to market pressure.”

To conclude their discussion, all the panel participants agreed that a European strategy for growth including elements of privatisation was needed. Yet what role should the new European Commission play in all of this? Former minister Saccomanni called for a strong investment effort at a European level. MEP Goulard suggested defining strategic sectors. “The issue of control is a key question,” she said. “We should define at a European level what is strategic, and this we should defend together, possibly through ownership and possibly through regulation.”

In his conclusions, Wolfgang Schüssel returned once more to the benefits of privatisation, calling for the new EU Commission to organise the expertise at a European level. “There are many things on the agenda of the new Commission,” he said. “Privatisation is one of the key elements of a new growth agenda for the coming years.”

Photos: Philippe Veldeman