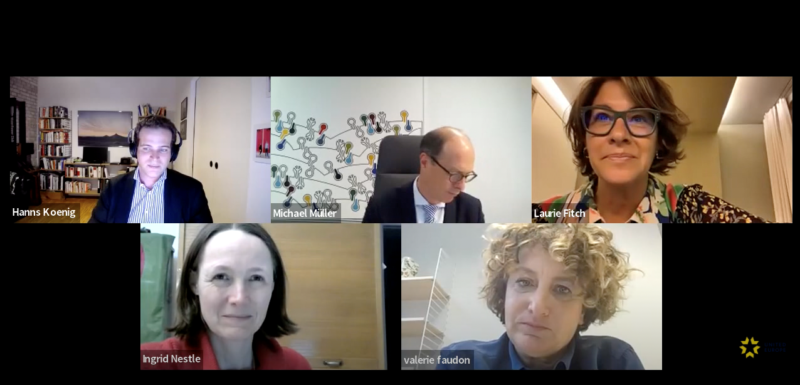

Our virtual Advocacy Webinar in partnership with Aurora Energy Research took place on 24th February via Zoom. We were joined by an all-star panel with Michael Müller (CFO of RWE), Valerie Faudon (DG of SFEN – Societe Francaise d’Energie Nucleaire), Laurie Fitch (Partner at PJT Partners), and Ingrid Nestle (MP and energy/climate spokesperson at Bündnis90/Die Grünen) to discuss whether natural gas and nuclear should count as “green” under the new EU Taxonomy for sustainable activities. The panel was moderated by United Europe’s longtime member and Advocate Hanns Koenig, Head of Commissioned Projects, Central Europe at Aurora Energy Research.

Please find the recording of the webinar on our YouTube channel.

Summary:

The EU taxonomy is a classification aimed at helping financial markets define what is green or what is not

green, so as to avoid greenwashing and accelerate green investments. The EC proposed to include

nuclear and natural gas into the taxonomy, subject to them fulfilling certain criteria. Although the proposal

was highly controversial, the EC decided to move forward, hoping the two sectors can help the bloc meet

its ambitious roadmap to climate neutrality. Coincidentally, Russia invaded Ukraine on the same day of the

webinar, which in the meantime has pushed up natural gas prices significantly and resulted in a push in

Europe to reduce reliance on Russian gas. This may result in a strong move towards a financially viable

option of “green” hydrogen, as well as other alternatives to natural gas, over the long term, reducing at

least the impact of including natural gas in the taxonomy.

Key Conclusions:

Michael Müller (RWE) suggested that whether a company’s activities are “green” should be judged by

how it spends its CAPEX, rather than its legacy activities, because CAPEX clearly demonstrates how

much investment is put into new technologies. The automotive, chemical, and steel industries face huge

investment needs. Looking at the status quo alone will not help transform energy markets.

Although the Green Party has been traditionally against gas, Ingrid Nestle (Bündnis90/The Greens) sees

the need in providing energy security through gas-fired power plants. She took a strong stand against

nuclear, and pointed to the still unresolved issue of nuclear waste management and to delays in the buildup of new nuclear power plants in Western Europe: “They are a decade late and it doesn’t take a decade to build them. They are one decade behind schedule.” Nuclear Power is much more expensive than renewable power and Europe should not spend more money, time, and political energy on nuclear, but instead focus on green infrastructure, Ingrid Nestle concluded.

Valerie Faudon (SFEN) from the French Nuclear Association, countered that nuclear is necessary for

energy security and that nuclear forms an important part of the energy transformation process: It is a

question of Europe’s competitiveness, Valerie said. Europe needs to take an international perspective:

reducing emissions is a global issue and nuclear will be part of other taxonomies, for example in the US or

Canada.

Laurie Fitch (PJT) highlighted the urgency of energy security. The power sector is not an industry where

supply chain failures can be blamed on blackouts. It is essential, she said: “Given the sheer sums of

money and time horizons involved in investing in green infrastructure, it has to be very clearly classified.

Therefore the taxonomy is highly important and really matters to capital flows.” Consequently, the

taxonomy underpins a much wider definition of what might be considered sustainable. There’s a five

hundred billion per annum fast-growing green bond market, and capital flows will definitely pay attention to the taxonomy.

Full Interview (edited):

HK: RWE is investing in power generation assets across Europe. How does the taxonomy affect large

power generators?

Michael Müller, RWE

The taxonomy provides a classification for activities that are sustainable and supports investors or the

capital market to make decisions on where to invest. It provides a classification and in principle, this is a good approach: But in practice, it is an administrative burden in particular to large power generators. The

taxonomy criteria are based on sustainable and non-sustainable activity, which is a totally different

perspective to be documented and it takes huge effort to provide the reporting.

HK: The German Green Party has been traditionally quite critical of including gas and nuclear in

the taxonomy. Now the Green Party is in government in Germany, and supported a compromise

that included natural gas and nuclear as “green” – why?

Ingrid Nestle, Bündnis90/TheGreens: The taxonomy is a good approach but the inclusion of both

nuclear and gas makes it less credible. Nuclear is definitely treated too well and it is a huge mistake to

include it. A technology that delivers waste to be guarded for ten thousand years cannot be sustainable.

Natural gas is another story: here, one has to differentiate between fossil gas and gas-fired power plants,

which can run with different types of gas including hydrogen in the future. These power plants are not only

acceptable, but they are also necessary for the 100 percent renewable future.

HK: Is nuclear treated fairly in the taxonomy or are the restrictions in place too strong?

Valerie Faudon, SFEN, Nuclear is one of the lowest emission sources in France. Waste management is heavily regulated and controlled in Europe. There is for example a deep geological storage solution to store nuclear waste where it is not in contact with the biosphere. In the taxonomy, nuclear is classified in the “transition” category. Hence, technical conditions have to be revised every four years. This is difficult because nuclear plants are set to operate for 60 years. Even with renewables, Europe relies on nuclear power due to its ability to be stored and scaled. The current 2050 scenario of the European Commission includes that nuclear will produce 15% of electricity in Europe in 2050.

HK: Does the taxonomy matter in shifting capital flows, or are we attributing too much impact to

the discussion over the past month? Has that been overblown?

Laurie Fitch, PJT Partners: Sustainability really matters when it comes to capital flows. The taxonomy

underpins a much wider definition of what might be considered sustainable. If you look at the capital flows, there’s a five hundred billion per annum fast-growing green bond market, and capital flows will ultimately pay attention to the taxonomy.

HK: The taxonomy means micromanagement and administrative burden for energy generators.

Would it not be more sensible to get rid of it altogether and let market forces and ETS run their

course? We can get rid of the taxonomy or the micromanagement altogether. Would that not have

been a more sensible approach?

MM, RWE: The taxonomy could be more pragmatic but introducing classification is clearly helpful. To

make investments green, there needs to be some kind of green classification. For industry, it is very

important that the taxonomy looks at two different criteria: firstly, how much of your revenues are

sustainable and how much are not sustainable, and secondly CAPEX, the sustainability of investments.

That is a very important difference. RWE has a heavy legacy coal portfolio but also a clear commitment to

transform that portfolio into a renewables portfolio. This is the transition that needs financing. We are

strongly pushing for the taxonomy to look at CAPEX because it is clearly demonstrating how much

investment is put into new technologies and how much speed you really put into transition. The

automotive, chemical, and steel industries have huge costs ahead of them and that needs funding.

Looking at the status quo doesn’t help the energy transformation.

Ingrid Nestle: The current proposal is in the hand of the parliament and this is what we have to work with.

In regards to nuclear, I heartily disagree that we know how to deal with waste. They are very strict

regulations because it’s so extremely difficult to deal with. We still don’t have a solution, but also nuclear

will simply be too late and too expensive. In my opinion, it’s kind of a hoax. All three new nuclear power

plants that are being built in Western Europe are a decade late. It doesn’t take a decade to build them.

They are one decade behind schedule. And there’s so much more expensive than renewables that are just

tearing away money, time, and political energy.

We now need to start talking about green infrastructure. How do we make sure that existing gas networks

or converted gas networks are available for hydrogen? We have to get electrolysis up and running so that

we get to a hydrogen economy. We are talking about 15 years. That sounds a lot. But I give you an

example: the biggest electrolyzer that is currently operational has 10 megawatts. The target is 10

gigawatts by the end of 2030. So that’s a huge step to get there. That’s why I asked for pragmatism. I think

we now need to get it all running, get it going because otherwise, we won’t need it at all.

HK: Is this black and white distinction in the taxonomy helpful and would we not have been better

advised of having three statuses, of “not clean, but helping us to get cleaner”?

Laurie Fitch, PJT Partners: The power sector is not an industry where supply chain failures can be

blamed. It has to work! It is essential. Given the sheer, sums of money and time horizons involved in

investing in green infrastructure, it has to be very clearly classified.

Valerie Faudon, SFEN: I’d like to add an international perspective: The European taxonomy is not going

to be the only taxonomy. And there will be other taxonomies for example in Canada or the US taxonomy.

In the American taxonomy, nuclear will be included. American capital will be investing in Europe. There is

an opportunity for new nuclear reactors in Poland, and the Americans have promised to invest here. It’s a

question of competitiveness. Europe must be competitive in its own continent. It is important that we take

an international view at some point in time: We have to harmonize taxonomies worldwide. If we don’t align,

it is going to create disruptions in the competitiveness of European industries.

HK: How are you seeing the global landscape for taxonomies shaping up?

Michael Müller, RWE: There are tons of rating agencies out there with different ratings and different

perspectives. So from our point of view, it indeed would be helpful if there is some alignment going

forward. We need a global standard on sustainability reporting, as we have on financial reporting. That will

provide a single framework. If we have one standard in the EU, it is clearly helpful as an intermediate step.

In the medium term, we need to have international standards to make it comparable. But again, that’s the

pragmatism I’m talking about. There must be a clear ambition to move towards an international standard.

And if you look at what is currently happening, it is moving in this direction.

Ingrid Nestle: The European Commission’s energy strategy focuses predominantly on green hydrogen

when it comes to energy transformation. It is clear that there won’t be enough renewable resources in

Europe to produce the hydrogen we need to keep our lights on. We have to be careful not to go from one

dependency to the next i.e. sourcing green hydrogen from Africa or other faraway countries. In Africa, you

have several million people without electricity. We can’t ask these countries to provide us with low carbon

hydrogen before they can provide their own people with the basic electricity supply.