Privatisation can help reduce public debt, boost growth and increase productivity – EU Member States own corporate assets of more than half a trillion euro

EU member states could generate more than half a trillion euro in revenue through the privatisation of publicly held assets. This is the result of a study conducted by the Austrian research institute Economica on behalf of United Europe. A Europe-wide privatisation initiative could help reduce public debt, allow governments to boost growth, and increase productivity. This would open up a new perspective for ending the current stagnation and regaining economic growth in Europe.

“The Economica study shows that if we addressed privatisation in a serious manner, 500 to 600 billion euro could be raised”, said the President of United Europe, the former Austrian Chancellor Wolfgang Schüssel, at the presentation of the results on Monday in Brussels. United Europe is an independent pro-European non-profit association set up in 2013 by prominent business people and politicians. United Europe promotes a united, competitive and diverse Europe.

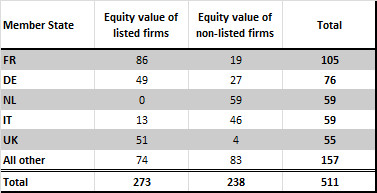

Economica calculated the market value of equity in firms that are owned in part or completely by public authorities in the EU. According to the study, EU member states own productive capital in the manufacturing and service sector worth over half a trillion euro. Sovereign mandates, the education and health sector as well as real estate assets held directly by the state were not included in the study.

The study focuses on fourteen EU Member States which together account for 90 percent of overall value added and 89 percent of overall employment in the European Union. These include the ten largest Eurozone member states according to the gross domestic product (Germany, France, Italy, Spain, Netherlands, Belgium, Austria, Finland, Greece and Portugal) and four EU member states outside the Eurozone (United Kingdom, Poland, the Czech Republic and Romania).

EU member states could use the proceeds from privatisation to repay some of their debt, said Christian Helmenstein, one of the authors of the study. But even if all the publicly held shares analysed in this study were sold off, this would not generate enough revenue to reduce public debt to the pre-crisis levels. Therefore member states ought to use some of the privatisation proceeds to finance investment which would help boost growth.

Beyond the short-term perspective, privatisation leads to significant and long-lasting productivity increases by approximately 20 percent in labour productivity. Privatisation thus improves the competitiveness of firms which in turn helps safeguard jobs.

The expected effect on growth from the privatisation of non-listed firms only amounts to a permanent increase of European GDP by 24 billion Euro or approximately 0,2 percent. That is why the European Union and its Member States should pursue privatisation as an essential and integral component of their economic strategy.

“Privatisation is a very useful instrument to overcome structural weaknesses and increase the productivity of companies which would make us more prosperous,” said Wolfgang Schüssel. “With privatisation, we can really boost growth.”

For further inquiries please contact:

Julia Borrmann () or

Markus Fichtinger ()

The complete study can be requested at:

Felicia Kerschbaum ()

More information on United Europe is available under www.united-europe.eu or from the project directors:

Christoph Riess (+49-172 625 0125) and Bettina Vestring (+49-160-973 50 679).